You may consider using the same company and annual report that you chose for your

Week 1 – Discussion Forum

, Reading and Using the Annual Report Case Study. This choice will work only if the company is using the straight-line depreciation method. The company’s choice of depreciation method can be located in the notes to the financial statement in the annual report. If the company does not use this method or does not have long-term assets, you will need to choose another company. Select a company that a fellow student has not already posted.

Using your selected company’s financial statement,

Your initial response should be a minimum of 200 words. Graduate school students learn to assess the perspectives of several scholars. Support your response with at least one scholarly and/or credible resource, in addition to the text.

Attached is Week 1 Discussion 1 needed to answer this discussion

Running Head:

WEEK 1 DISCUSSION

2

WEEK 1 DISCUSSION 2

Week 1 Discussion Forum

Marquita Green

Ashford University

My company of interest that trades on the New York Stock Exchange is General Electric (GE).

Current ratio = current assets/current liabilities

Year 2019: Current assets = $126.066 billion

Current liabilities = $74.259 billion

Current ratio = 126.066/74.259

= 1.698: 1

This current ratio indicates that General Electric can meet its current liabilities 1.698 times using its current assets before they are depleted.

Year 2018: Current assets = $107.922 billion

Current liabilities = $60. 451 billion

Current ratio = 107.922/60.451

= 1.785:1

This ratio shows that GE can meet its current liabilities using its current assets 1.785 times.

In comparing these two ratios, GE performed better in the year 2018 as compared to 2020.

Profit margin = gross profit/revenue * 100

Year 2019: gross profit = $25.186 billion

Revenue = 95.214 billion

Profit margin = 25.186/95.214 * 100

= 26.45%

This ratio indicates that 26.45% of total sales was gross profit.

Year 2018: Gross profit = 24. 194 billion

Revenue = 97.0112 billion

Profit margin = 24.194/97.0112 * 100

= 24.94%

This ratio shows that 24.94% of sales was gross profit.

In the latest report, the management discussion and analysis comments show that GE’s unrealized losses are attributed to the fair value of its securities which have been in a loss position. The comments also indicate that the current valuation was also not well adhered to thus altering the results. GE’s 2019 financial year auditor was Klynveld Peat Marwick Goerdeler (KPMG). KPMG gave an unqualified report for the year 2019.

GE has been on the right trajectory in terms of performance over time and has established sound accounting mechanisms and reporting. In the latest audited financial reports, it has had a truthful and fair presentation of financial transactions. (Casey & Pearce, 2018)

References

Casey, D., & Pearce, D. (Eds.). (2018). More Than Management Development: Action Learning at General Electric Company. Routledge.

Wise, G. (2020). Willis R. Whitney, General Electric and the Origins of US Industrial Research. Plunkett Lake Press.

Essay Writing Service Features

Our Experience

No matter how complex your assignment is, we can find the right professional for your specific task. Achiever Papers is an essay writing company that hires only the smartest minds to help you with your projects. Our expertise allows us to provide students with high-quality academic writing, editing & proofreading services.

Free Features

Free revision policy

$10Free bibliography & reference

$8Free title page

$8Free formatting

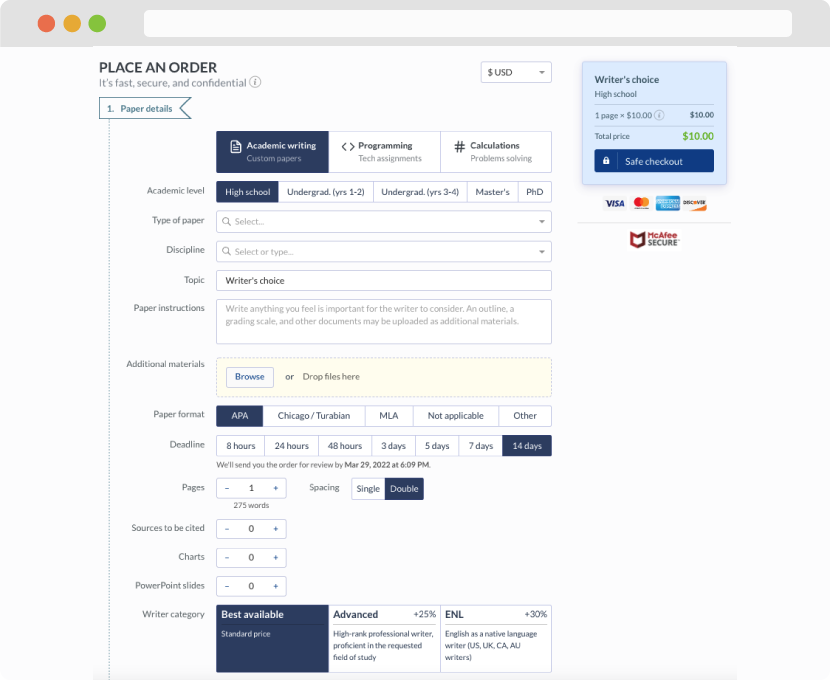

$8How Our Dissertation Writing Service Works

First, you will need to complete an order form. It's not difficult but, if anything is unclear, you may always chat with us so that we can guide you through it. On the order form, you will need to include some basic information concerning your order: subject, topic, number of pages, etc. We also encourage our clients to upload any relevant information or sources that will help.

Complete the order form

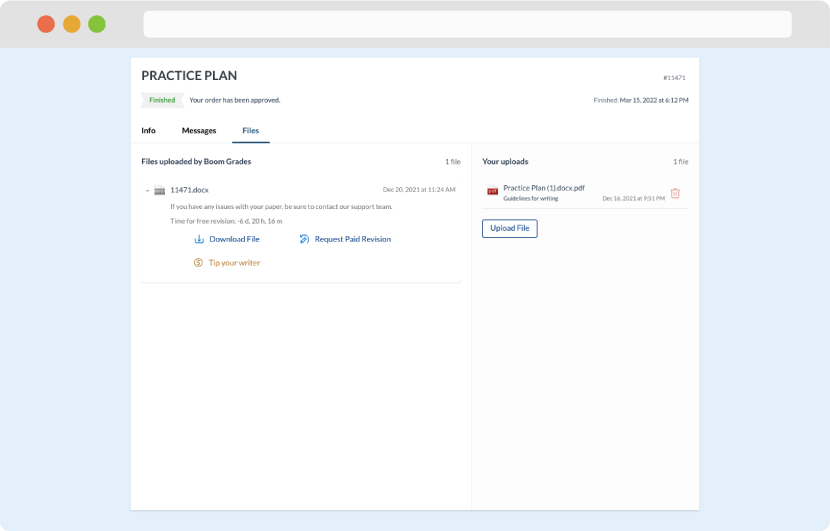

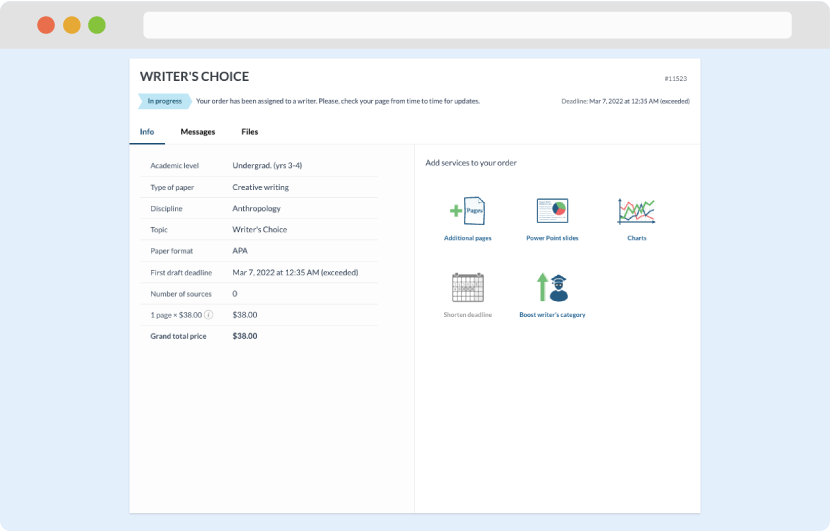

Once we have all the information and instructions that we need, we select the most suitable writer for your assignment. While everything seems to be clear, the writer, who has complete knowledge of the subject, may need clarification from you. It is at that point that you would receive a call or email from us.

Writer’s assignment

As soon as the writer has finished, it will be delivered both to the website and to your email address so that you will not miss it. If your deadline is close at hand, we will place a call to you to make sure that you receive the paper on time.

Completing the order and download