I just wanted to clarify that I created the following tables based on the Income Statement, Trial Balance, and the instructions given in Part B of the task:

Profit & Loss Account

Profit & Loss Appropriation Account

Current Account – Hari

Current Account – Jane

I applied the rules as outlined in the textbook, such as:

The Profit & Loss account records:

• All business expenses and incomes to calculate net profit

• The following items relating to individual partners are treated as business expenses/incomes:

• Interest on Loans by a partner

• Interest on Advance/Loan to a partner

• Salaries to Partners.

The Profit & Loss Appropriation account records:

•The Net Profit transferred from the Profit & Loss account.

•Any Interest on Capital credited to partners on balances of their capital accounts.

•Any Interest on Drawings charged to partners on the amount of their drawings.

•The Share of Profits to the partners in accordance with the partnership agreement.

The Current account is used to record all other transactions affecting the equity of the partner:

•Share of profits.

•Partner’s salary (if credited and not paid).

•Drawings.

•Interest on “fixed” capital.

•Interest on drawings.

•Any adjustments between the partners.

(An annual salary of $10,000 which is not paid in cash, is to be credited to Jane (at the end of each financial year on 30 June))

I truly feel that I followed the correct structure, yet today I received this feedback:

Unfortunately, your answers are completely wrong. These are ledger accounts, not statements. You have to have the closing balance marked by CR/DR in each line. Each account must have an opening balance and a closing balance. You either move the closing balance to another account and bring it to NIL, or keep the closing balance (depending on the nature of the account).

You need to study the relevant material carefully, practice the examples given in the collaborative session 5, and in the textbook (Chapter 5 – Part 2) and try this question from scratch.

I’m confused and also starting to feel frustrated after being told several times that my answers are wrong, even though I’ve carefully applied what’s in the textbook.

Could you please take a look at my tables and provide specific feedback on what exactly is incorrect? I really want to understand where I’m going wrong so I can improve. And please write balance cells too.

Essay Writing Service Features

Our Experience

No matter how complex your assignment is, we can find the right professional for your specific task. Achiever Papers is an essay writing company that hires only the smartest minds to help you with your projects. Our expertise allows us to provide students with high-quality academic writing, editing & proofreading services.

Free Features

Free revision policy

$10Free bibliography & reference

$8Free title page

$8Free formatting

$8How Our Dissertation Writing Service Works

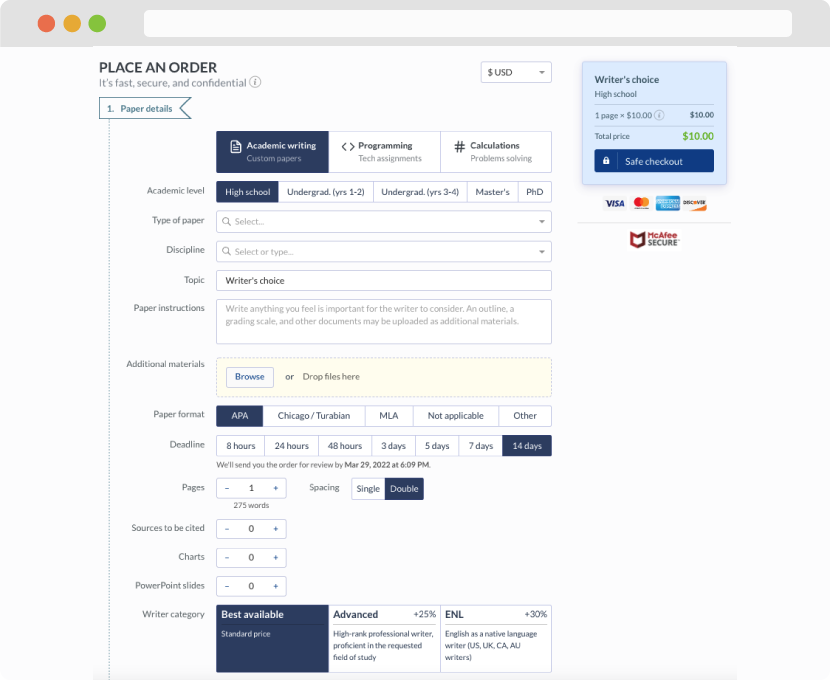

First, you will need to complete an order form. It's not difficult but, if anything is unclear, you may always chat with us so that we can guide you through it. On the order form, you will need to include some basic information concerning your order: subject, topic, number of pages, etc. We also encourage our clients to upload any relevant information or sources that will help.

Complete the order form

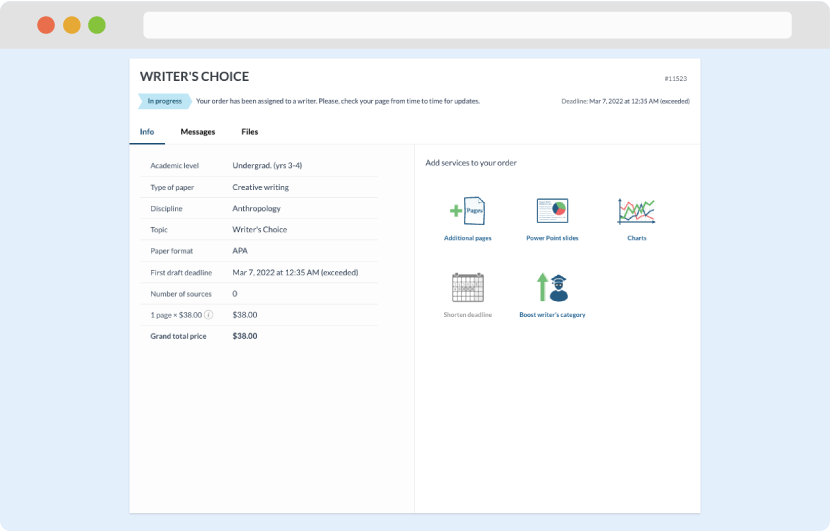

Once we have all the information and instructions that we need, we select the most suitable writer for your assignment. While everything seems to be clear, the writer, who has complete knowledge of the subject, may need clarification from you. It is at that point that you would receive a call or email from us.

Writer’s assignment

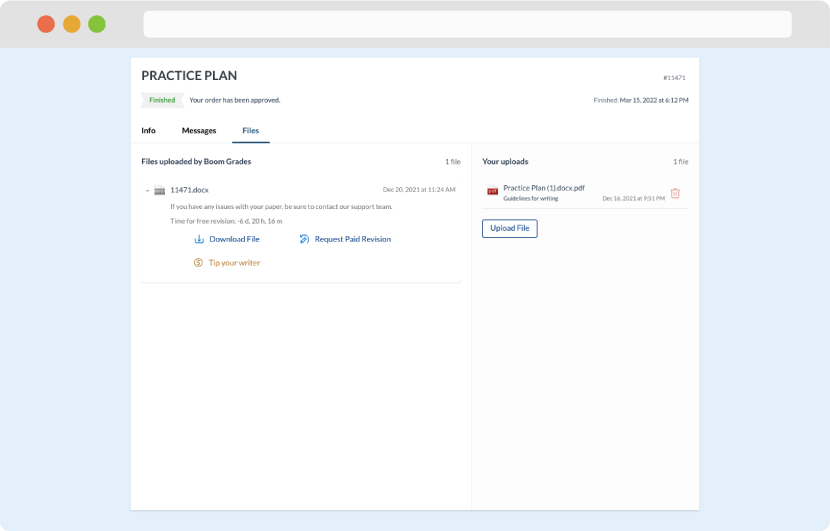

As soon as the writer has finished, it will be delivered both to the website and to your email address so that you will not miss it. If your deadline is close at hand, we will place a call to you to make sure that you receive the paper on time.

Completing the order and download