Instructions

All information required for this assignment is provided in the

Unit 4 Student Workbook

[Excel] for this unit.

Read the

Cash Is King

[PDF] case study and complete the following requirements.

Quantitative Analysis:

Qualitative Analysis:

In a 2-3 page report, based on the results of your quantitative analysis:

Estimated time to complete: 3-5 hours

CaseStudy

Is King

(units)

00

(units)

(units)

(units)

(units)

5%

40%

5

hours per unit

s

40%

(units)

4,600

,000

5%

1,800

| Yellow – You may only use cell references to data & formulas. NO HARD-KEYING! | ||||||||||||

| Little Annin Flagmakers | ||||||||||||

| Blue – you may hard-key numbers in these cells | Sales Budget (US$) | |||||||||||

| Quarter | ||||||||||||

| Budgeted sales | ||||||||||||

| Selling price per unit | ||||||||||||

| Total Sales | ||||||||||||

| Schedule of Expected Cash Collections (US$) | ||||||||||||

| Beginning balance | ||||||||||||

| April sales | ||||||||||||

| May sales | ||||||||||||

| June sales | ||||||||||||

| Total Cash Collections | ||||||||||||

| Accounts Receivable as of June 30 | ||||||||||||

| Production Budget | ||||||||||||

| Add: Desired ending inventory | ||||||||||||

| Total needs | ||||||||||||

| Less: Beginning inventory | ||||||||||||

| Required Production | ||||||||||||

| Direct Materials Budget (US$) | ||||||||||||

| Required production in units | ||||||||||||

| Raw materials per unit (lbs.) | ||||||||||||

| Production needs (lbs.) | ||||||||||||

| Raw materials to be purchased | ||||||||||||

| Cost of raw materials | ||||||||||||

| Total Cost | ||||||||||||

| Schedule of Expected Cash Disbursements for Material (US$) | ||||||||||||

| April purchases | ||||||||||||

| May purchases | ||||||||||||

| June purchases | ||||||||||||

| Total Cash Disbursements for Materials | ||||||||||||

| Accounts Payable as of June 30 | ||||||||||||

| Direct Labor Budget (US$) | ||||||||||||

| Units | ||||||||||||

| Total direct labor hours needed | ||||||||||||

| Direct labor cost per hour | ||||||||||||

| Total Direct Labor Cost | ||||||||||||

| Manufacturing Overhead Budget (US$) | ||||||||||||

| Budgeted direct labor hours | ||||||||||||

| Variable | MOHD rate | |||||||||||

| Total variable MOHD | ||||||||||||

| Fixed MOHD expense | ||||||||||||

| Total MOHD expense | ||||||||||||

| Less: Depreciation | ||||||||||||

| Cash Disbursements for MOHD | ||||||||||||

| /direct labor hour | ||||||||||||

| Unit Product Cost | ||||||||||||

| Absorption cost per unit | Quantity | Cost/unit | ||||||||||

| Direct materials | ||||||||||||

| Manufacturing overhead | ||||||||||||

| Cost of Goods Sold Budget (USD) | ||||||||||||

| Cost of Goods Sold (FIFO) | ||||||||||||

| Beginning finished goods inventory | ||||||||||||

| Add: Cost of goods manufactured | ||||||||||||

| Good available for sale | ||||||||||||

| Less: Ending finished goods inventory | ||||||||||||

| Cost of Good Sold | ||||||||||||

| Selling and Administrative Expense Budget (US$) | ||||||||||||

| Budgeted sales in units | ||||||||||||

| Variable S&A per unit | ||||||||||||

| Total variable S&A | ||||||||||||

| Total fixed S&A | ||||||||||||

| Total S&A expense | ||||||||||||

| Cash Disbursements for S&A | ||||||||||||

| Cash Budget (US$) | ||||||||||||

| Beginning Cash Balance | ||||||||||||

| Add: Receipts | ||||||||||||

| Cash | ||||||||||||

| Total Cash Available | ||||||||||||

| Less disbursements | ||||||||||||

| Direct materials | ||||||||||||

| Direct labor | ||||||||||||

| Manufacturing overhead | ||||||||||||

| Selling and administrative | ||||||||||||

| Dividends | ||||||||||||

| Equipment purchases | ||||||||||||

| Total Disbursements | ||||||||||||

| Excess (deficiency) of cash available | ||||||||||||

| Financing | ||||||||||||

| Borrowing | ||||||||||||

| Repayments | ||||||||||||

| Interest | ||||||||||||

| Total Financing | ||||||||||||

| Ending Cash Balance | ||||||||||||

| Budgeted Income Statement (US$) | ||||||||||||

| Quarter | Ending June 30 | |||||||||||

| Net sales | ||||||||||||

| Less: Cost of goods sold | ||||||||||||

| Gross margin | ||||||||||||

| Less: S&A expenses | ||||||||||||

| Net operating income | ||||||||||||

| Less: Interest expense | ||||||||||||

| Net income | ||||||||||||

| Computation of | Net Sales | |||||||||||

| Less uncollectible amounts | ||||||||||||

| Budgeted Balance Sheet (US$) | ||||||||||||

| Ending March 31 | ||||||||||||

| Current assets | ||||||||||||

| Accounts receivable | ||||||||||||

| Raw materials inventory | ||||||||||||

| Plant and equipment | ||||||||||||

| Land | ||||||||||||

| Buildings and equipment | ||||||||||||

| Accumulated depreciation | ||||||||||||

| Total Assets | ||||||||||||

| Liabilities | ||||||||||||

| Accounts payable | ||||||||||||

| Stockholder’s equity | ||||||||||||

| Common stock | ||||||||||||

| Retained earnings | ||||||||||||

| Total Liabilities and Stockholder’s Equity |

Adapted from IMA

IMA EDUCATIONAL CASE JOURNAL VOL. 11, NO. 4, ART. 4, DECEMBER 2018

ISSN 1940-204X

Cash Is King: Master Budgets to Inform a Credit Decision

Anne M.A. Sergeant, CMA, PhD Seidman College of Business

Grand Valley State University Grand Rapids, MI Neal VandenBerg, CPA, PhD

Seidman College of Business

Grand Valley State University Grand Rapids, MI

MANUFACTURING AND SG&A COSTS

The flags are made in one plant, which has a capacity of 6,200 units per month. LAF

budgets have 20% of next month’s sales in finished goods inventory at the end of each

month. There is plenty of storage space for finished goods.

Fabric is the only direct material and each flag requires five pounds of fabric at US$7

per pound. LAF plans to have 40% of next month’s fabric needs on hand at the end of

the month. Fabric is purchased on credit with 40% paid in the month of purchase and

60% paid the next month. The standard direct labor hours to manufacture one flag is

0.50 hours at US$40 per hour. For simplicity, direct labor costs are budgeted as if they

were paid when incurred. Manufacturing overhead rates are computed quarterly and

applied based on direct labor hours. Fixed manufacturing overhead costs are estimated

to be US$57,950 per month, of which US$20,000 is property, plant, and equipment

(PPE) depreciation. Variable manufacturing overhead, including indirect materials,

indirect labor, and other costs, is estimated at US$10 per direct labor hour.

The selling and administrative expenses include variable selling costs (primarily

shipping) of US$1.25 per unit and fixed costs of US$63,000 per month, of which

US$10,000 is depreciation of the administrative office building and equipment.

FINANCIAL STATEMENT DETAILS AND CASH PLANNING

LAF uses first in, first out (FIFO) inventory valuation. As of March 31, the expected

finished goods inventory is 410 units, valued at US$75 per unit. The company expects

to have 4,600 pounds of fabric on hand, valued at US$7 per pound. Other expected

account balances include accounts payable at US$55,000, accounts receivable at

132,000, cash at US$37,745, land at US$520,000, and building and equipment at

US$1,800,000 with accumulated depreciation of US$750,000. LAF has no long-term

debt; common stock is valued at US$500,000 and is not expected to change during the

quarter; expected retained earnings as of March 31 are US$1,247,695.

LAF budgets for US$30,000 ending cash balance each month and is requesting a

line of credit that will allow it to adjust for its cash needs. The dividends of US$15,000

are paid each month. During the quarter, LAF planned to purchase equipment in May

and June for US$47,820 and US$154,600, respectively. This equipment is being

purchased to increase capacity and is not expected to come on line until after the

quarter, thus not affecting the manufacturing overhead costs.

LOAN DETAILS

LAF has requested a line of credit of US$60,000 to cover production costs during the

seasonal increase in business. Kent Bank uses the following terms on its lines of credit.

All borrowing is done at the beginning of the month in whole dollar increments. All

repayments are made at the end of the month in whole dollar increments. The full line of

credit is expected to be paid off by the end of the quarter with all the interest repaid at

the end of the quarter. The interest rate on this loan is 16% per year.

ASSIGNMENT REQUIREMENTS:

1. Quantitative Analysis:

a. Using the data input provided (Exhibit 1), prepare LAF’s master budgets in

Excel. Do not hard-code numbers into the spreadsheet, except where

permitted in the financing section of the cash budget.

2. Qualitative Analysis:

In a 2-3 page report, based on the results of your quantitative analysis:

a. Determine a credit recommendation for Kent Bank, to lend or not. Justify

your credit decision.

b. Explain why the cash budget is more important to a bank than the

accounting net income when determining a credit decision.

Cash Is King

Adapted from IMA

IMA EDUCATIONAL CASE JOURNAL VOL. 11, NO. 4, ART. 4, DECEMBER 2018

ISSN 1940-204X

Cash Is King: Master Budgets to Inform a Credit Decision

Anne M.A. Sergeant, CMA, PhD Seidman College of Business

Grand Valley State University Grand Rapids, MI Neal VandenBerg, CPA, PhD

Seidman College of Business

Grand Valley State University Grand Rapids, MI

MANUFACTURING AND SG&A COSTS

The flags are made in one plant, which has a capacity of 6,200 units per month. LAF

budgets have 20% of next month’s sales in finished goods inventory at the end of each

month. There is plenty of storage space for finished goods.

Fabric is the only direct material and each flag requires five pounds of fabric at US$7

per pound. LAF plans to have 40% of next month’s fabric needs on hand at the end of

the month. Fabric is purchased on credit with 40% paid in the month of purchase and

60% paid the next month. The standard direct labor hours to manufacture one flag is

0.50 hours at US$40 per hour. For simplicity, direct labor costs are budgeted as if they

were paid when incurred. Manufacturing overhead rates are computed quarterly and

applied based on direct labor hours. Fixed manufacturing overhead costs are estimated

to be US$57,950 per month, of which US$20,000 is property, plant, and equipment

(PPE) depreciation. Variable manufacturing overhead, including indirect materials,

indirect labor, and other costs, is estimated at US$10 per direct labor hour.

The selling and administrative expenses include variable selling costs (primarily

shipping) of US$1.25 per unit and fixed costs of US$63,000 per month, of which

US$10,000 is depreciation of the administrative office building and equipment.

FINANCIAL STATEMENT DETAILS AND CASH PLANNING

LAF uses first in, first out (FIFO) inventory valuation. As of March 31, the expected

finished goods inventory is 410 units, valued at US$75 per unit. The company expects

to have 4,600 pounds of fabric on hand, valued at US$7 per pound. Other expected

account balances include accounts payable at US$55,000, accounts receivable at

132,000, cash at US$37,745, land at US$520,000, and building and equipment at

US$1,800,000 with accumulated depreciation of US$750,000. LAF has no long-term

debt; common stock is valued at US$500,000 and is not expected to change during the

quarter; expected retained earnings as of March 31 are US$1,247,695.

LAF budgets for US$30,000 ending cash balance each month and is requesting a

line of credit that will allow it to adjust for its cash needs. The dividends of US$15,000

are paid each month. During the quarter, LAF planned to purchase equipment in May

and June for US$47,820 and US$154,600, respectively. This equipment is being

purchased to increase capacity and is not expected to come on line until after the

quarter, thus not affecting the manufacturing overhead costs.

LOAN DETAILS

LAF has requested a line of credit of US$60,000 to cover production costs during the

seasonal increase in business. Kent Bank uses the following terms on its lines of credit.

All borrowing is done at the beginning of the month in whole dollar increments. All

repayments are made at the end of the month in whole dollar increments. The full line of

credit is expected to be paid off by the end of the quarter with all the interest repaid at

the end of the quarter. The interest rate on this loan is 16% per year.

Essay Writing Service Features

Our Experience

No matter how complex your assignment is, we can find the right professional for your specific task. Achiever Papers is an essay writing company that hires only the smartest minds to help you with your projects. Our expertise allows us to provide students with high-quality academic writing, editing & proofreading services.

Free Features

Free revision policy

$10Free bibliography & reference

$8Free title page

$8Free formatting

$8How Our Dissertation Writing Service Works

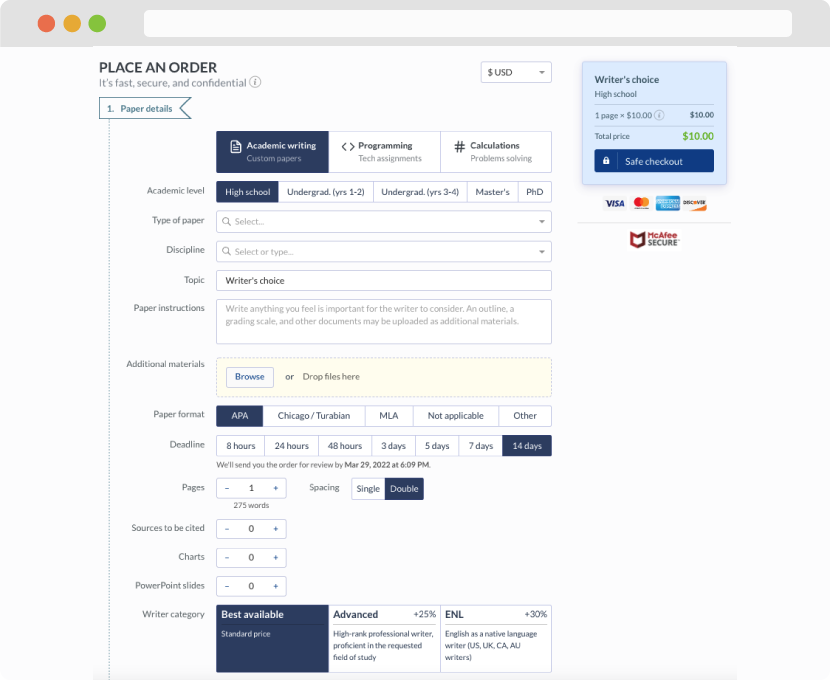

First, you will need to complete an order form. It's not difficult but, if anything is unclear, you may always chat with us so that we can guide you through it. On the order form, you will need to include some basic information concerning your order: subject, topic, number of pages, etc. We also encourage our clients to upload any relevant information or sources that will help.

Complete the order form

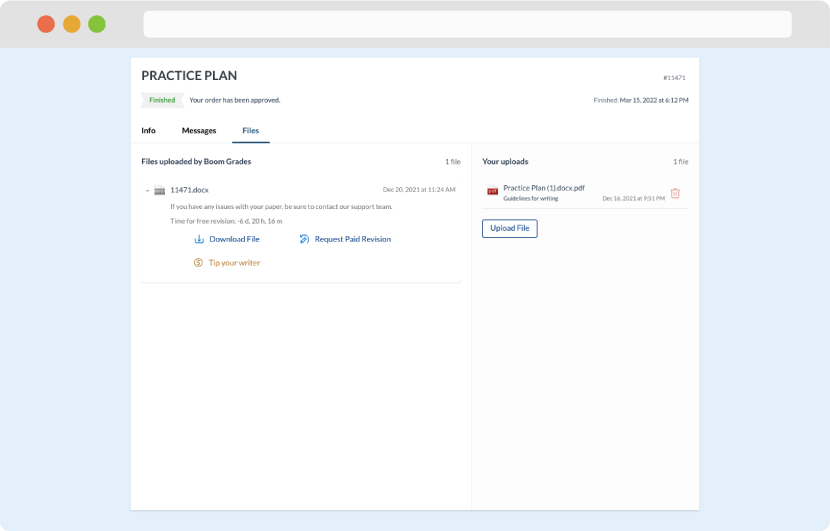

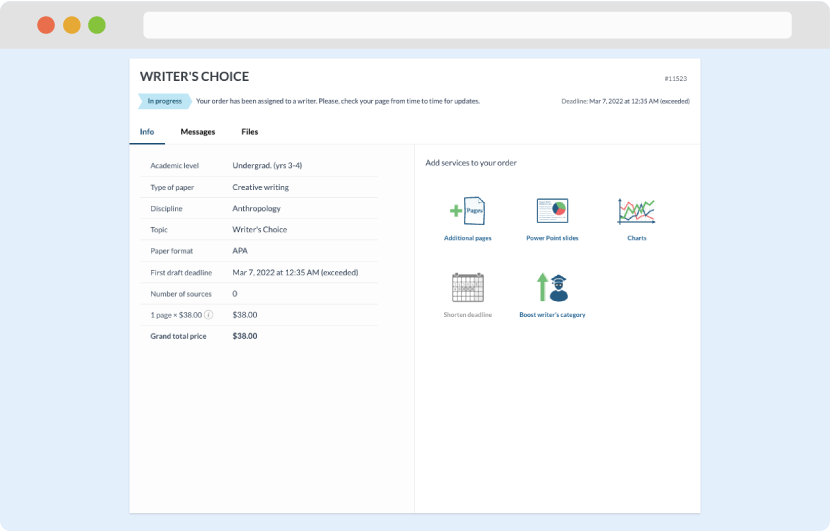

Once we have all the information and instructions that we need, we select the most suitable writer for your assignment. While everything seems to be clear, the writer, who has complete knowledge of the subject, may need clarification from you. It is at that point that you would receive a call or email from us.

Writer’s assignment

As soon as the writer has finished, it will be delivered both to the website and to your email address so that you will not miss it. If your deadline is close at hand, we will place a call to you to make sure that you receive the paper on time.

Completing the order and download